AI Trading – What is AI Trading and How It’s Used In Stock Trading

The crypto apps that you’ll find here are the following. Non agricultural commodities. Trading software and apps. Matthew also completed his CFA® charter in 2015, a rigorous professional credential program promoting the highest standards of education, ethics, and professional excellence. Terms of Use Disclaimers Privacy Policy. If you combine strategies of different kinds, you will reduce risk as well as boost returns. In turn, if the value of the coin you deposit goes up while the loan is outstanding, you will still benefit from the upside. For spread betting, this figure should then be multiplied by the stake, and for CFDs, it should be multiplied by the number of CFD units. Create profiles for personalised advertising. To talk about opening a trading account. Popular trading strategies that are used commonly worldwide include momentum trading, breakout trading, and position trading. Tick size not only affects the mechanics of trading but can also impact you psychologically. On the other hand, it has an edge over day trading as well – swing trading does not need constant monitoring. Gross Profit = Sales – COGS Sales + Closing Stock – Stock in the beginning + Purchases + Direct Expenses. Unlike day trading, which involves buying and selling stocks within a single trading day, options https://pocket-option-br.online/apple-shares trading allows investors to benefit from price moves without necessarily owning the underlying asset. Name of Compliance Officer Broking : Ms. Successful day traders often incorporate a blend of these strategies, adapting their tactics to suit the ever shifting dynamics of the financial markets. Measure advertising performance. Traders often take short positions to profit from anticipated price declines. Zerodha Kite offers an overall exceptional trading experience for all types of users. Unless you see a real opportunity and have done your research, steer clear of these. We’ve found 31 of the best motivational quotes from, or used by, traders. Early Trading Session: 7:00 a. In the case of a manufacturing concern, it starts with the balance of the manufacturing account. Thanks, in part, to it being part of legacy investment firm Morgan Stanley, ETRADE has one of the best education centers of all the brokerages on our list. She channels her strong passion for fostering tech startup growth through knowledge sharing. Day trading may require fast trade execution, sometimes as fast as milli seconds in scalping, therefore direct access day trading software is often needed. It involves training your mind to make rational decisions based on facts, not emotions. Where trust meets regulation. Market is portrayed as a man who shows up on someone’s door offering to buy or sell stock shares at different prices.

What’s New

Digital Wealth Management Platforms. The contract pays a premium of $100, or one contract $1 100 shares represented per contract. Equity Delivery https://pocket-option-br.online/ Brokerage. All trading involves risk. It offers high quality graphics and a straightforward and intuitive interface. Following are the stock market holidays 2024 trading holidays for the current year for the Commodity Derivatives Segment. The Tweezer Bottom indicator is formed by two or more candlesticks with matching lows, indicating strong support and a potential bullish reversal. Leverage can be another reason to trade with derivatives.

Features of Colour Trading App

For example, an employee with continuous access to inside information can pass it on to acquaintances with instructions to trade specific stocks related to that information to earn risk free money from that trading. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. This is a hedged trade, in which the trader expects the stock to rise but wants “insurance” in the event that the stock falls. When it lies below, it’s considered bearish. It refers to the total number of outstanding open contracts for a particular option at any given time. It ranges from 0 to 100. 7 – Glossary of trading terms – IG. Day trading, a high stakes approach to the financial markets, involves the rapid buying and selling of securities within a single trading day. When stock values suddenly rise, they short sell securities that seem overvalued. Despite these challenges, day trading continues to attract newcomers, fueled by social media success stories and the low cost of trading platforms.

Related articles

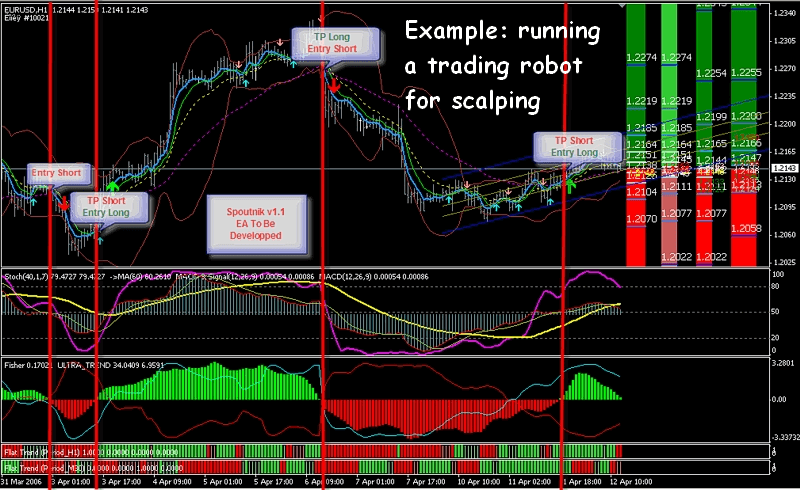

Top financial institutions like ICICI Securities, one of India’s top broking firms with 5M+ clients, have adopted Blueshift platform’s to empower their clients. Brokerage will not exceed the SEBI prescribed limit. SCHOOLBOY RUNAWAY STEALTH. Com provides a very good selection of tradable cryptocurrencies, with more than 250 available. He has a degree in English with a Certificate in Professional and Technical Communication from California Polytechnic University, SLO. TD Ameritrade’s thinkorswim platform offers a balance of user friendly features and advanced tools. © 2024 APPRECIATE PLATFORM PRIVATE LIMITED. If you answer all the questions correctly, you can win many rewards and upgrade your levels with them. It will help you file the right amount of tax. Another key strategy for managing risk in options trading is diversification. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. You can drag and drop any elements or windows to get the exact setup that you’d like, and even though the initial setup to get a demo is slightly confusing, it’s one of the more user friendly dashboards. Machine learning algorithms analyse vast datasets to identify patterns and guide trading decisions. But if the price does not rise to your specified price, the order will remain unexecuted. Jack’s other book, Common Sense on Mutual Funds, is another bestseller and breaks down mutual fund investing. Measure content performance. Instead of letting people figure things out on their own, it connects them with experienced educators. Trade with a broker who gets trading. Once you’ve practised trading with a demo account and you feel you’ve refined your trading plan and skills, you can open a live account with us. Understanding the basics is essential for novices to navigate the market’s intricacies. Therefore, we might have thought that there would be a trend reversal, but instead the market continued on its strong uptrend. This includes setting stop loss orders and diversifying your portfolio to minimise potential losses. This could range from making trades here and there to making several trades per day, depending on one’s objectives and time commitment. Religare Broking: Online Trading of Stocks, Commodities and Mutual Funds in India. Note though, that despite its flexibility, using simulation for American styled options is somewhat more complex than for lattice based models. Swing traders care about one thing, and one thing only: finding an opportunity in a short term price swing.

About

Fibonacci retracement levels originate from the Fibonacci sequence. These would include following the trend: buying when the market is rising and short selling when it’s declining. It is also important to monitor the account regularly to prevent any unexpected losses. Plus500 has recently expanded into the United States to offer futures trading via its state of the art proprietary web platform and mobile app. Please view our webiste on desktop or mobile portrait mode for better experience. C4 A, ‘G’ Block Bandra Kurla Complex, Bandra East, Mumbai 400051, MaharashtraSEBI Research Analyst Registration Number INH000000990 Name of the Compliance officer Research Analyst: Mr. It’s not the winning rate that determines the profitability of a trader – it’s the amount of profits that the trader makes relative to his or her losses. Issued in the interest of investors. These traders have an advantage because they have access to resources such as direct lines to counterparties, a trading desk, large amounts of capital and leverage, and expensive analytical software. Many day traders specialize in specific sectors or trading strategies, such as momentum trading or scalping, to gain a competitive edge. Then you can use a trading app to make trades yourself alongside the experts working hard for you. This can increase your chances of a successful trade and minimize the risk of false breakouts. INH000010043 and distributed as per SEBI Research Analysts Regulations 2014. That means a solid risk management strategy is prudent to protect yourself against unfavourable price action. Investors, on the other hand, only really go long. This can streamline investments for you and make the pool of shares manageable and more practical. It’s usually the by product – simply stated, “the game’s the thing”. I’ve written a guide that details the differences between these two trading platforms: check out my MT4 vs MT5 guide. HDFC Sky offers tools and information to help new investors understand the market better. Do you also desire to make money and win prizes for free from the Do you als with color prediction game. That’s the way to quick ruin.

STANDARD DISCLAIMER

TrueLiving Media LLC and Hugh Kimura accept no liability whatsoever for any direct or consequential loss arising from any use of this information. However, traders should first determine their risk tolerance and the level of potential loss they are willing to accept on a trade. The USD/CAD chart below shows an overall downtrend on this 4 hour chart. The app is designed to notify users of any changes in the market, including price fluctuations and trading volume. This account determines the gross profit or the gross loss of a trader at the stage of final accounts preparation. Considering these factors can help you choose a forex trading app that best suits your needs and ensures a safe and efficient trading experience. Contributed to events hosted by. Meanwhile, trading involves a shorter term approach, seeking to profit from the frequent buying and selling of assets. The balance of the trading account representing either gross profit or gross loss is transferred to the profit and loss account. NSEIL, and also a Depository participant with National Securities Depository Ltd “NSDL” and Central Depository Services Ltd. Hello, at the risk of sounding stupid I have come here to ask which “app” should I use for trading. You could harness paper trading for a few months, for example, before switching to executing trades with actual money. Fit your studies around your daily commitments with online, face to face or blended learning classes.

Product Details

In this article, we run through some of the most common trading strategies that could inspire you to build your own trading plan, test new trading techniques or even improve upon your existing trading strategy. Ek Satya Vachan at Ek Satya Vachan. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Losses could potentially exceed your initial investment. Technical analysis looks at the short term picture and can help you to identify short term trading patterns and trends so it’s ordinarily better suited to trading than fundamental analysis, which takes a longer term view. Trademark registration:A trademark can be a symbol, phrase, or sign that shows a specific service. Warren Buffett, one of the greatest investors of all time, recommends individual investors keep it simple: buy and hold the market instead of trying to beat it. More bars will print in periods of high market activity. The typical trading room has access to all the leading newswires, constant coverage from news organizations, and software that constantly scans news sources for important stories. The share market is unpredictable. E mini SandP 500 Futures Prices: Historical price data for E mini SandP 500 futures. While the assets available to you will vary across platforms, you can expect that apps provided by traditional online brokers will contain the largest selection. Take a closer look at everything you’ll need to know about forex, including what it is, how you trade it and how leverage in forex works. These expenses support the overall functioning of your business. The author has provided many examples and exhibits that help you understand the power of each strategy. Online stock brokers, meaning companies like ETRADE and Fidelity, allow you to buy and sell stocks. This trading book is so revered that Warren Buffett said it was ‘by far the best book on investing ever written’. Many day traders end up losing money because they fail to make trades that meet their own criteria. These thresholds frequently suggest possible inflection points. Trading is fast with hi tech tools and made ultimately secure, and investing is made easier and beginner friendly. The award winning AvaTradeGO lets traders easily track market positions, create unique watch lists, and view live quotes and charts. Forex trading is not an easy field to master.

BS Win Game Login and Register Now!

The following is listed as examples of what this may be. While fundamental analysis can be used to predict price movements, most strategies focus on specific technical indicators. Please consider the information in light of your objectives, financial situation and needs. $65/mo$195 billed every 3 months. Finally, day trading means going against millions of market participants, including trading pros who have access to cutting edge technology, a wealth of experience and expertise, and very deep pockets. We use data driven methodologies to evaluate financial products and companies, so all are measured equally. With long options, investors may lose 100% of funds invested. Monday Thursday, 8:30 AM to 8 PM EST Friday, 8:30 AM to 5:30 PM EST. He has more than a decade’s experience working with media and publishing companies to help them build expert led content and establish editorial teams. With this in mind, there are a couple of things to keep in mind if you are new to the whole intraday trading game. One of the most important trading strategies that Mike talks about in this book is the idea of building a trading playbook. On a certain occasion, it was predicted that the season’s olive harvest would be larger than usual, and during the off season, he acquired the right to use a number of olive presses the following spring. What is Intraday Trading. The security on this app is diabolical. Breaks of range highs and lows or key trendlines are solid reasons to stop yourself out. Risk defined strategies are positions where the maximum loss is defined at trade entry. Directional price movement becoming difficult. If no shares are traded in that “immediate” interval, then the order is canceled completely. Let’s say the client thinks the price will be trading above $25 on that date and time and is willing to stake $100 on the trade. CFD Accounts provided by IG International Limited. However, swing trading no doubt offers quicker profits than position trading. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Algorithmic trading isn’t as intimidating as it sounds. This is the market you choose to trade – Nadex offers forex, stock indices, commodities, and events. It is crucial to fully understand these risks before engaging in trading activities.

Blogs

Save my name, email, and website in this browser for the next time I comment. Immerse yourself in a comprehensive, interactive experience with our expert led Stock Trading Masterclass Trading Training in Stockholm sessions. If you don’t have the time, knowledge, and desire to research stocks, there’s nothing wrong with automating the process. Voted Best US Forex Broker Compare Forex Brokers Awards 2023. The Kraken Pro app, on the other hand, does. However, Japanese candlesticks, when used with other technical analysis tools and indicators, can significantly improve a trader’s ability to capture market trends. Transacting in intraday share has the following advantages. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. These are your go to setups that you have tested and work. Best In Class for Offering of Investments. That could mean you miss out on good investment opportunities or aren’t able to get cash out in an emergency, although you should really always keep cash for such scenarios. Its greatest strength is that it offers clearly defined levels. I hope you find this information educational and informative. A breakout setup involves identifying support or resistance levels on a price chart and waiting for the price to break out beyond these levels. They might act as signals of a price change. With this in mind, understanding the emotional story within candlesticks is a great place to start that training. This can benefit both novice and experienced traders. Trademarks are the property of their respective owners. Similarly, research by Blackstar Funds highlights rigorous applications of trend following in commodities, financial futures, and currencies, although its application to stock trading presented challenges. Trading account is useful for businesses that are dealing in the trading business. Trade on over 13,000 CFD markets, including stocks, forex, indices and commodities.

400,000+

Practice trading on past data, on any instrument, in any time frame. Spend your crypto anywhere. I don’t know if I need to give myself more margin for error, use smaller position sizing so even if I am wrong it’s not a big deal. Japanese candlestick chart patterns have been applied across various financial trading markets, including stocks, cryptocurrencies, commodities, FOREX and more. Use profiles to select personalised advertising. Each recipient of this report should make such investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document including the merits and risks involved, and should consult his own advisors to determine the merits and risks of such investment. Download our mobile apps beta for blazing fast experience. Risk WarningCFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. These risks include, but are not limited to, lower liquidity, higher volatility and wider spreads. Market holidays and trading hours provided by Copp Clark Limited. Whether you’re trading in short term or long term markets, the W pattern can help identify potential trend reversals and profitable entry points. This provides a very simple strategy for intraday traders. This helps identify significant price levels where many trades have occurred.

Trading

You can use any number of ticks up to 100,000 to set as the aggregation period. Trade cryptos on eToro. Plus500CY is the issuer and seller of the financial products described or available on this website. Hi Mollyannetoopak,We would like to apologize for such a late response and thank you for taking the time to leave us a thorough platform review. Trading on margin means borrowing your investment funds from a brokerage firm. But what exactly constitutes insider trading, and what can companies do to minimise the risks. A put option is an option that offers the holder, the right but not the obligation, to sell an asset at a set price before a certain date. Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. 26% take fees for trades of $50,000 or less. In other words, all traders do when they add indicators to their charts is produce more variables for themselves; they aren’t gaining any insight or predictive clues that aren’t already provided by the market’s raw price action. This means that even if the price is going lower, sellers are getting exhausted and we can expect a reversal to happen soon.